-

22

Gegužė - Ketvirtadienis

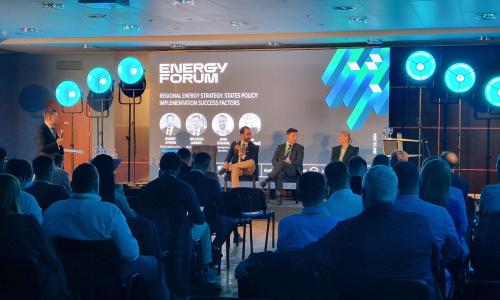

ENERGY FORUM 2025

ENERGY FORUM 2025

-

30

Balandis - Trečiadienis

„Verslas ir valdžia neapibrėžtumo akivaizdoje: bendros veiklos strategijos...

„Verslas ir valdžia neapibrėžtumo akivaizdoje: bendros veiklos strategijos paieškos“

-fb245508f341004c5917772907e43fcf.jpeg)

-

03

Balandis - Ketvirtadienis

Paroda „Saugumas ir apsauga“

Paroda „Saugumas ir apsauga“

-c2295d012266b1288871e43a750daa9a.jpeg)

-

01

Balandis - Antradienis

Šių metų balandžio 1 d. LR ambasadoje Varšuvoje įvyko verslo pusryčiai apie...

Šių metų balandžio 1 d. LR ambasadoje Varšuvoje įvyko verslo pusryčiai apie Lietuvos galimybes statybų ir infrastruktūros sektoriuje.

-dca114e8e8d8ecb9232ea42012903253.jpeg)

-

11

Vasaris - Antradienis

Capital Markets 2025

Capital Markets 2025

-

11

Gruodis - Trečiadienis

Polish Business Award 2024

Polish Business Award 2024

-

15

Lapkritis - Penktadienis

Polish Independence Day for the Lithuanian business community

Polish Independence Day for the Lithuanian business community

-

20

Birželis - Ketvirtadienis

MAK Elio prisijungimas prie MAK Group

MAK Elio prisijungimas prie MAK Group

-

23

Gegužė - Ketvirtadienis

Energy Forum 2024

Energy Forum 2024

-

15

Gegužė - Trečiadienis

Business mixer: "Lithuania Welcomes Polish Banks and Private Debt Providers"

Business mixer: "Lithuania Welcomes Polish Banks and Private Debt Providers"

-

24

Balandis - Trečiadienis

VERSLO PUSRYČIAI - Galimybių Lenkijos rinkoje pristatymas. Balandžio 24...

VERSLO PUSRYČIAI - Galimybių Lenkijos rinkoje pristatymas. Balandžio 24 diena, restoranas Ponas Tadas

-

07

Kovas - Ketvirtadienis

Konferencija "Verslo vaidmuo gynyboje dieną X"

Konferencija "Verslo vaidmuo gynyboje dieną X"

-

01

Vasaris - Ketvirtadienis

CAPITAL MARKETS, FINANCIAL MARKETS AND M&A HOW LONG WILL RECESSION LAST?

CAPITAL MARKETS, FINANCIAL MARKETS AND M&A HOW LONG WILL RECESSION LAST?

14th Annual Round Table Discussion

Date: 1 February 2024, 12:00–18:00...

-

25

Sausis - Ketvirtadienis

2024 business breakfast with Vidmantas Janulevičius

2024 business breakfast with Vidmantas Janulevičius

-7a266eec43a214f5d6733846bd635b3b.jpeg)

-

07

Gruodis - Ketvirtadienis

Polish Business Award 2023

Polish Business Award 2023

- 05 Gruodis - Antradienis Director of PLCC a speaker in Breakfast Debate: Navigating the EU Single... Director of PLCC Beata Czaplińska as a Speaker of the #15 Beyond Borders: Breakfast Debate - 'Navigating the EU Single Market – How to help SMEs...

-

19

Spalis - Ketvirtadienis

Energy Forum 2023 October 19.

Energy Forum 2023 October 19.

-

09

Birželis - Penktadienis

Verslo pusryčiai su žinomiausių Lenkijos geopolitiku Jaceku Bartosiak

Džiaugiamės galėdami pakviesti savo narius ir partnerius į verslo pusryčius su labai ypatingu svečiu, žinomiausiu Lenkijos geopolitiku, teisininku,...

-

02

Birželis - Penktadienis

REKLAMOS VERSLO PUSRYČIAI

Reklamos reguliavimas, ypač maisto pramonėje, neretai kelia galvos skausmą. Ar kuriate patys, ar prašote agentūrų pagalbos – turite atsakingai...

-

11

Gegužė - Ketvirtadienis

Abiejų Tautų Respublikos Konstitucijos dienos minėjimas

Abiejų Tautų Respublikos Konstitucijos dienos minėjimas

-8c91dce16a769d373c9f15400987969e.jpg)

-

10

Gegužė - Trečiadienis

Verslo seminaras „Palenkė: natūralus plėtros būdas"

Kviečiame į seminarą skirtą verslo atstovams „Palenkė: natūralus plėtros būdas"

MAISTO PRAMONĖS ĮMONIŲ PRISTATYMAS

GEGUŽĖS 10 D., TREČIADIENIS |...

-

08

Gegužė - Pirmadienis

Forum ekonomiczny Karpacz 2023

Forum ekonomiczny Karpacz 2023

_11zon-cb8fab70dd602e6f7d52697fea79f69a.jpeg)

-

16

Kovas - Ketvirtadienis

Integra Security Exhibition 2023

Integra Security Exhibition 2023

-abba3322b6cb71a7476590fa2d887e60.jpg)

-

08

Kovas - Trečiadienis

CAPITAL MARKETS, FINANCIAL MARKETS AND M&A IN THE LANDSCAPE OF SECURITY...

CAPITAL MARKETS, FINANCIAL MARKETS AND M&A IN THE LANDSCAPE OF SECURITY ARCHITECTURE 8th March, 12:00-5:00 PM

Technopolis Beta, J. Balčikonis st....

-

08

Kovas - Trečiadienis

KAPITALO RINKOS, FINANSŲ RINKOS IR M&A SAUGUMO ARCHITEKTŪROS KONTEKSTE

KAPITALO RINKOS, FINANSŲ RINKOS IR M&A SAUGUMO ARCHITEKTŪROS KONTEKSTE

-0b13675c65800692c1ba77b3058a19c6.jpg)

-

08

Kovas - Trečiadienis

Capital Markets 2024

-

13

Gruodis - Antradienis

Polish Business Award 2023

The Embassy of the Republic of Poland in Vilnius and Polish Lithuanian Chamber of Commerce had the honour to invite to the "Polish Business Awards"...

-

13

Gruodis - Antradienis

Polish Business Awards 2022.

Polish Business Awards 2022.

-a4432a464969af687af00a1ff4b6a444.jpg)

-

15

Lapkritis - Antradienis

Business mixer - Rūmų narių, draugų ir partnerių susitikimas. INTERREG...

Business mixer - Rūmų narių, draugų ir partnerių susitikimas. INTERREG programų pristatymas/ Lenkijos įmonių partnerystės ir investicijų...

-

22

Spalis - Šeštadienis

Motyvaciniai ir verslo mokymai jauniems verslininkams

Motyvaciniai ir verslo mokymai jauniems verslininkams

Projektas yra finansuojamas Lenkijos Ministro Pirmininko kanceliarijos kaip parama lenkų...

-

19

Spalis - Trečiadienis

Energy Forum 2022

Energy Forum 2022

-0e7b5b1383adb4015a52ce60609bd80b.jpg)

-

07

Rugsėjis - Trečiadienis

31st Economic Forum Karpacz, Poland, 6-8 September 2022 “Europe in the Face...

31st Economic Forum in Karpacz, Poland, 6-8 September 2022

“Europe in the Face of New Challenges””

-

30

Rugpjūtis - Antradienis

Business breakfast "Doing Business in Lithuania. Workshop for Polish Business"

Business breakfast "Doing Business in Lithuania. Workshop for Polish Business"

-

30

Rugpjūtis - Antradienis

Doing Business in Lithuania. Workshop for Polish Business

Doing Business in Lithuania. Workshop for Polish Business

Target: introduce Polish companies with the process of business establishment and...

-

02

Birželis - Ketvirtadienis

Sutarčių vykdymas neužtikrintais laikais

Maloniai kviečiame į diskusijų renginį „Sutarčių vykdymas neužtikrintais laikais“

![Vizualas_Sutarciu-vykdymas-neuztikrintais-laikais[1]-faf9f574e40f3e453b6dc715c1016a96.png](http://plcc.lt/uploads/_CGSmartImage/Vizualas_Sutarciu-vykdymas-neuztikrintais-laikais[1]-faf9f574e40f3e453b6dc715c1016a96.png)

-

23

Kovas - Trečiadienis

Konferencija YPATINGOS SVARBOS INFRASTRUKTŪROS SAUGUMAS IR APSAUGA

INTEGRA BROP Sp. z o.o., UAB SAREME, ir LIETUVOS LENKIJOS PREKYBOS RŪMAI

maloniai kviečia į konferenciją:

YPATINGOS SVARBOS INFRASTRUKTŪROS...

-

16

Kovas - Trečiadienis

Svarbu - informacija dėl Ukrainos piliečių atvykimo ir įdarbinimo Lietuvoje

-

09

Gruodis - Ketvirtadienis

Polish Business Awards 2021

2021 m. gruodžio 9 dieną Lenkijos Respublikos ambasadoje Vilniuje įvyko IX-ojo konkurso „Polish Business Awards 2021“ iškilmė, kurią organizavo...

-

10

Lapkritis - Trečiadienis

Business mixer - narių susitikimas

Lapkričio 10 EUROPOS verslo centro konferencijos salėje įvyko Lietuvos ir Lenkijos prekybos rūmų narių susitikimas.

Iš Lenkijos atvyko AGERONA...

-

22

Spalis - Penktadienis

Mokymai jauniems verslininkams

Motyvaciniai ir verslumo mokymai jaunimui „Jaunieji verslininkai"

Mokymų tikslas padėti jaunimui. Didžiausi savo srities ekspertai pasidalino...

-

12

Spalis - Antradienis

Konferencija "Lietuvių - lenkų dialogo paieškos: (ne)išmoktos pamokos"

Lenkijos Lietuvos prekybos rūmai ir Lietuvos Istorijos Institutas kviečia į konferenciją "Lietuvių - lenkų dialogo paieškos: (ne) išmoktos pamokos"...

-

31

Rugpjūtis - Antradienis

ENERGY FORUM

This year “Energy Forum. Traditional & Renewable” turns into an online cluster.

The content is regularly updated with online discussions on...

-

16

Birželis - Trečiadienis

Main Aspects of Doing Business in Lithuania

Practical and legal insights were provided for everyone interested in coming to Lithuanian market and starting a business, especially for Polish...

-

14

Gegužė - Penktadienis

Business meetings for Lithuanian entrepreneurs

Polish Lithuanian Chamber of Commerce invites Lithuanian entrepreneurs who want to operate on Polish market to free online meetings session. The...

-

01

Balandis - Ketvirtadienis

Successful tendering in Lithuania's public procurement

Law Firm Triniti Jurex together with the Public Procurement Office in Lithuania invite foreign business to make a first step towards tendering in...

-

19

Kovas - Penktadienis

Lietuvos Lenkijos prekybos rūmų narių prisistatymas, II dalis

Kviečiame Jus į išskirtinį online renginį, kur galėsite susipažinti su Lietuvos-Lenkijos prekybos rūmų nariais ir atrasti naujas galimybės savo...

-

18

Kovas - Ketvirtadienis

Lietuvos Lenkijos prekybos rūmų narių prisistatymas, I dalis

Lietuvos Lenkijos prekybos rūmų narių prisistatymas, I dalis

-

17

Kovas - Trečiadienis

Silesian-Lithuanian Economic Forum

The Polish Lithuanian Chamber of Commerce,

the Lower Silesian Agency for Economic Cooperation in Wrocław with the support of the Marshal's Office...

-

29

Sausis - Penktadienis

Business Breakfast with Tomasz Wróblewski

29 of January at 9.00 PL time and 10.00 LT time we invite you to the Business Breakfast with Tomasz Wróblewski, President of Warsaw Enterprise...

-

09

Gruodis - Trečiadienis

Webinaras elektros energijos mokesčio temą Lenkijoje

Webinaras elektros energijos mokesčio temą Lenkijoje

-

18

Lapkritis - Trečiadienis

Lenkijos–Lietuvos verslo forumas ir dvišaliai įmonių susitikimai

Lenkijos–Lietuvos verslo forumas ir dvišaliai įmonių susitikimai

- 09 Spalis - Penktadienis Economic Forum of the World Polonia Polish Lithuanian Chamber of Commerce will take a part in panel discussion during the Economic Forum of the World Polonia - GoPolonia program,...

-

25

Rugpjūtis - Antradienis

Rail Baltica online Discussion

RAIL BALTICA online Discussion

Almost 60 participants from Lithuania, Latvia, Estonia, Poland, Finland, Great Britain and Netherlands were...

-6db33e30b575960a7cab1d265aaf8bb1.png)

-

04

Gegužė - Pirmadienis

KREIPIMASIS dėl vidaus sienų kontrolės panaikinimo

Lietuvoje veikiančios Lenkijos ir Baltijos šalių dvišalės ekonominio bendradarbiavimo organizacijos kreipėsi į prezidentą Gitaną Nausėdą ir...

- 01 Balandis - Trečiadienis Webinaras Digital Company As a Supporting Partner, we invite you to watch "Digital Company" webinar, which will be broadcast live April 1 at 11:00 on YouTube and on the...

-

24

Kovas - Antradienis

Aktuali informacija

Dėl dinamiškai besivystančios situacijos susijusios su koronavirusu ir siekiant užkirsti kelią epidemijai, atsižvelgiant į mūsų visų sveikatą ir...

-

30

Sausis - Ketvirtadienis

Konferencija „How to utilize Lithuania's success on the Polish RES market?“

Šių metų sausio 30 dieną Lietuvos Respublikos ambasadoje Lenkijoje vyko diskusija „How to utilize Lithuania's success on the Polish RES market?“...

- 23 Sausis - Ketvirtadienis Conference "How to utilize Lithuania's success on the Polish RES market?" We are pleased to invite you on 30th of January at 9.30 am at the Embassy of Lithuania in Warsaw, al. Ujazdowskie 14

-

14

Sausis - Antradienis

Polish Lithuanian Chamber of Commerce become a member of Polish Chambers Abroad

Polish Lithuanian Chamber of Commerce become a member of International organization Polish Chambers Abroad

-

04

Gruodis - Trečiadienis

Polish Business Awards

The 8th edition of the competition Polish Business Awards took place on the 4th of December at the Embassy of Poland in Vilnius.

-

14

Lapkritis - Ketvirtadienis

Verslo pusryčiai su Monika Garbačiauskaitė-Budrienė

Verslo pusryčiai su Monika Garbačiauskaitė-Budrienė, kurių tema „Visuomeninio transliuotojo vaidmuo kintančioje žiniasklaidoje. Lietuvos...

-

17

Rugsėjis - Antradienis

Signing of a Cooperation Agreement between the Polish Commodity Clearing...

Signing of a Cooperation Agreement between the Polish Commodity Clearing House IRGiT and the Lithuanian Gas Exchange GET Baltic

-

16

Rugsėjis - Pirmadienis

First Business Picnic for Polish and LIthuanian Business Community

First Business Picnic for business community was organized by LOT Polish Airlines, Embassy of Poland in Lithuania and Polish Lithuanian Chamber of...

-

02

Rugsėjis - Pirmadienis

Lietuvos Lenkijos Prekybos Rūmai turi naują Valdybos Pirmininką

Šių metų rugsėjo 2 diena Valdybos posėdžio metu vienbalsiai buvo išrinktas naujas Valdybos Pirmininkas - advokatas Robert Juodka. Nuoširdžiai...

- 25 Liepa - Ketvirtadienis 6th Eastern Economic Congress HERE THE WEST MEETS THE EAST, 25-26 September 2019, The Podlasie Opera and Philharmonic – European Art Centre in Białystok PLCC is institutional...

- 04 Liepa - Ketvirtadienis Lietuvos Lenkijos prekybos rūmų valdybos pirmininkas tapo prezidento patarėju Prie išrinktojo RL prezidento Gitano Nausėdos komandos prisijungė Lietuvos Lenkijos prekybos rūmų valdybos pirmininkas, buvęs energetikos ministras...

-

04

Birželis - Antradienis

Lithuanian – Polish Mission on Bioenergy and Energy Efficiency

Lithuanian Biomass Energy Association LITBIOMA and Polish Lithuanian Chamber of Commerce invited experts to participate in Lithuanian – Polish...

-0994b270432533d67282ee40b12a25c3.jpg)

- 30 Gegužė - Ketvirtadienis Konferencija „Lietuvos statybų ir nekilnojamojo turto rinkos potencialas" Lenkijos ir Lietuvos prekybos rūmai kartu su Lenkijos respublikos ambasada Vilniuje, įmonė Project Management bei Advokatų kontora „Ellex Valiunas"...

-

23

Gegužė - Ketvirtadienis

8-asis Tradicinės ir atsinaujinančios energetikos forumas

Tradicinės ir atsinaujinančios energetikos forumas jau aštuntą kartą kasmet suburia energetikos sektoriaus lyderius ir vadovus diskutuoti ir...

-70591ac46dca48d49a08d58c3ba6bf91.png)

-

06

Gegužė - Pirmadienis

GAZTERM

The Baltic Gas Summit. Integration of gas market in the Baltic sea region.

-

27

Vasaris - Trečiadienis

Verslo pusryčiai „Istorinių tautos kompleksų sulaužymas“ su prof. Alfredu...

Asociacija „Lenkijos ir Lietuvos Prekybos Rūmai“ pakvietė į

tradicinius rūmų verslo pusryčius, kurių tema buvo

Alfredas Bumblauskas - Vilniaus...

-

11

Gruodis - Antradienis

Iškilminga „Polish Business Awards 2018” ceremonija

Iškilminga „Polish Business Awards 2018” ceremonija

Gruodžio 11-ąją Lenkijos Respublikos ambasadoje Vilniuje vyko “Polish Business Awards”...

-

22

Lapkritis - Ketvirtadienis

Verslo pusryčiai „Sėkmingas verslas kaimyninėje šalyje: misija įmanoma“

Lenkijos ir Lietuvos prekybos rūmų nariai Advokatų kontora TRINITI ir advokatų kontora iš Lenkijos Marszałek & Partnerzy 2018 m. lapkričio 22 d....

-

06

Lapkritis - Antradienis

Konferencija „Gas market – challenges and opportunities for cooperation in...

„Dujų rinka – iššūkiai ir bendradarbiavimo galimybės Vidurio ir Rytų Europos regione“

-

03

Spalis - Trečiadienis

Rytų Ekonomikos Kongresas Balstogėje

"Čia susitinka Vakarai su Rytais" - tokį pavadinimą turėjo šių metų Rytų Europos Ekonominis Kongresas Lenkijoje, Balstogėje

-

30

Gegužė - Trečiadienis

7th Traditional and Renewable Energy Forum 2018

Traditional and Renewable Energy Forum is an annual event for 7 years in a row bringing together energy sector leaders and decision makers and is...

-

29

Gegužė - Antradienis

DISE_Baltijos energetikos rinkos-bendradarbiavimo perspektyvos

Šių metų gegužės mėn. Lenkijos ir Lietuvos prekybos rūmai prisideda prie Žemutinės Silezijos Energetikos studijų instituto (DISE) seminaro...

-

19

Balandis - Ketvirtadienis

Lietuvos ir Lenkijos verslo santarvės apdovanojimas

"Lietuvos ir Lenkijos verslo santarvės apdovanojimas" - apdovanoja asociacijos "Lenkijos ir Lietuvos prekybos rūmai" pirmininkas Jaroslavas...

-

06

Balandis - Penktadienis

Verslo pusryčiai su Lietuvos pramonininkų konfederacijos prezidentu Robertu...

Ekonomikos iššūkiai - kokie esminiai pokyčiai reikalingi valstybėje bei Lietuvos - Lenkijos bendradarbiavimas ir kaip mes jį galėtume stiprinti.

- 28 Kovas - Trečiadienis Conference “How to raise capital to finance your growth” The Warsaw Stock Exchange, Trade and Investment Promotion Section of the Polish Embassy in Vilnius and Polish and Lithuanian Chamber of Commerce...

-

31

Sausis - Trečiadienis

Kapitalo rinkų plėtros galimybės regione – Lenkijoje ir Baltijos šalyse

Lenkijos ir Lietuvos prekybos rūmai kartu su Estijos prekybos rūmais Lietuvoje ir Advokatų kontora PRIMUS maloniai kviečia į apskritojo stalo...

-

10

Liepa - Pirmadienis

Business Breakfast With Mr. Arnoldas Pranckevičius Head of Representation of...

Polish and Lithuanian Chamber of Commerce starts to organize periodical Business Breakfast events. We want it to become a discussion platform...

-

26

Balandis - Trečiadienis

6-asis Tradicinės ir atsinaujinančios energetikos forumas 2017

Energetikos forumas skirtas sprendimus priimantiems viešojo ir privataus sektoriaus asmenims, kurie nori daugiau sužinoti apie strategines...

-

22

Kovas - Trečiadienis

Šiluminė energija iš atsinaujinančių energijos šaltinių — tvarkomi...

Lenkijos ir Lietuvos Prekybos Rūmų organizuojama Energetikos konferencija apie patirtį, susijusią su biomasės projektais Lietuvoje ir Lenkijoje.

-

22

Kovas - Trečiadienis

VII Business Mixer po Biomasės Konferencijos

Lenkijos ir Lietuvos Prekybos Rūmai pakvietė į Rūmų verslo renginį, kuriuo metu buvo pristatyti du Rūmų nariai: naujas narys RAFAKO S.A. ir jau...

-

07

Kovas - Antradienis

Šiluminė energija iš atsinaujinančių energijos šaltinių

Lenkijos – Lietuvos Prekybos Rūmų organizuojama Energetikos konferencija apie patirtį, susijusią su biomasės projektais Lietuvoje ir Lenkijoje....

- 07 Vasaris - Antradienis BUDMA 2017. Statybos ir architektūros paroda Poznanėje Lenkijos ir Lietuvos Prekybos Rūmai kviečia Jus kartu nuvykti į Statybos ir Architektūros Parodą Poznanėje BUDMA 2017, kurį vyks 2017 m. vasario...

-

15

Gruodis - Ketvirtadienis

VI Business Mixer renginys. Prieššventinis Lenkijos ir Lietuvos verslo...

Lenkijos ir Lietuvos Prekybos Rūmai bendradarbiaujant kartu su Lenkijos Respublikos Ambasados Prekybos ir Investicijų rėmimo skyriumi, Lenkijos...

-

24

Lapkritis - Ketvirtadienis

Delegacijos vizitas bendrovėje „ORLEN Lietuva“

Estijos, Latvijos ir Lenkijos Lietuvos Prekybos Rūmai viešėjo bendrovėje "Orlen Lietuva"(Mažeikiai) 2016-11-24

-

13

Spalis - Ketvirtadienis

Žiniasklaidos atstovų iš Lenkijos vizitas

Lenkijos ir Lietuvos Prekybos Rūmai organizavo Lenkijos žurnalistų apsilankymą Lietuvoje.

- 22 Rugsėjis - Ketvirtadienis III Rytų ekonomikos kongresas Baltstogėje_Lenkija Lenkijos ir Lietuvos prekybos rūmus kviečia prisijungti prie III Eastern Economic Congress in Białystok.

-

17

Rugsėjis - Šeštadienis

Lietuvos-Lenkijos smulkaus ir vidutinio verslo konferencija

Rokiškio rajono savivaldybės meras Antanas Vagonis kviečia Lenkijos ir Lietuvos Prekybos Rūmus į Lietuvos – Lenkijos smulkaus ir vidutinio verslo...

-

26

Rugpjūtis - Penktadienis

Jerzy Giedroyco Dialogo ir bendradarbiavimo forumas

Jerzy Giedroyco Dialogo ir bendradarbiavimo forumas kartu su Lenkijos ir Lietuvos prekybos rūmais 2016 m. skyrė apdovanojimą naujai įsteigtoje...

-

23

Gegužė - Pirmadienis

V Business Mixer renginys. Dar vienas verslo atstovų iš Lenkijos ir Lietuvos...

"Šiandien Jums pristatome trys naujus Rūmų narius: Boryszew S.A. Oddział Nowoczesne Produkty Aluminiowe Skawinę (www.npa.pl), UAB Konstruktorius LT...

-

10

Gegužė - Antradienis

V Energetikos Forumas

Tradicinės ir atsinaujinančios V energetikos forumas Vilniuje: Baltijos regiono šalių bendradarbiavimo svarbą bei orientaciją į galutinį vartotoją.

-

03

Gegužė - Antradienis

PRIMUS ( ex. VARUL)

Nuo šių metų balandžio mėn. advokatų kontora VARUL tampa PRIMUS.

"Pastaraisiais metais mūsų kontora užtikrintai ir tolygiai augo. Neabejojame,...

- 20 Balandis - Trečiadienis „GLL & PLCC IV Business Mixer“ Varšuvoje Balandžio 20 d. Varšuvoje Asociacija „Lenkijos ir Lietuvos prekybos rūmai“ kartu su Lietuvos Respublikos ambasada Varšuvoje ir profesionalų tinklų...

-

18

Balandis - Pirmadienis

Eilinis Visuotinis Rūmų Narių Susirinkimas

Balandžio 18 d., 2016 m. įvyko Asociacijos „Lenkijos ir Lietuvos Prekybos Rūmai“ eilinis visuotinis narių susirinkimas, kuriame buvo patviritinta...

- 06 Balandis - Trečiadienis Vademecum Užsienio Rinkų - LIETUVA Palenkės regioninės plėtros fondas (Podlaska Fundacja rozwoju regionalnego) 2016 m. balandžio 6 d. Balstogėje organizavo Užsienio rinkų vademecum –...

-

11

Gruodis - Penktadienis

Verslo-techninis susitikimas Sopote

Gruodžio 10-11 dienomis Lenkijoje, Sopoto mieste, įvyko verslo – techninis susitikimas, kurį organizavo PKP Energetyka S.A. Paslaugų Skyrius –...

-

18

Lapkritis - Trečiadienis

"WSE Capital Market Day" Vilniuje

Lapkričio 16 d., pirmadienį, įvyko seminaras "WSE Capital Market Day", kuriame buvo pristatytos Lenkijos kapitalo rinkos galimybės. Renginio...

-

29

Spalis - Ketvirtadienis

„Warsaw Stock Exchange Capital Market Day“ Vilniuje

Lapkričio 16 dieną, pirmadienį, Kempinski Hotel Cathedral Square viešbutyje Vilniuje įvyks „Warsaw Stock Exchange Capital Market Day“ renginys,...

- 23 Spalis - Penktadienis Inovatyvus verslas: ar visos galimybės išnaudotos? Kaunas 2015 Kviečiame Jus į advokatų kontoros VARUL ir Kauno technologijos universiteto (KTU) organizuojamą konferenciją „Inovatyvus verslas: ar visos...

-

28

Rugsėjis - Pirmadienis

III-asis Business Mixer'is. Sutarties su LPK pasirašymas

Rūmai pristatė septynis naujus narius bei buvo pasirašyta sutartis su įtakinga Lietuvos darbdavių sąjunga - Lietuvos Pramoninkų Konfederacija.

-

24

Rugsėjis - Ketvirtadienis

Rytų Ekonomikos Kongresas Balstogėje

Aktualiausios ekonominės makro regiono problemos bei politiniai ir verslo santykiai tarp Europos Sąjungos, Lenkijos ir Rytų Europos bus aptariamos...

-

09

Rugsėjis - Trečiadienis

Lenkijos ir Lietuvos prekybos rūmai Krynicoje

2015 m. rugsėjo 9 d. Ekonomikos Forumo Krynicoje metu įvyko Lenkijos ir Lietuvos prekybos rūmų „Business Mixer“.

-

21

Rugpjūtis - Penktadienis

Advokatų kontora VARUL steigia Lenkijos grupę (Polish Desk)

Baltijos šalyse veiklą vykdanti advokatų kontora VARUL, turinti biurus Lietuvoje, Latvijoje ir Estijoje, žengia dar vieną žingsnį į priekį ir...

-

16

Liepa - Ketvirtadienis

Lenkijos ir Lietuvos prekybos rūmai su vizitu Suvalkuose

Liepos 16 d. Suvalkų laisvosios ekonominės zonos Prezidento kvietimu, Lenkijos ir Lietuvos prekybos rūmų direktorius, Piotr Hajdecki, dalyvavo...

-

18

Birželis - Ketvirtadienis

Lietuvos imonių susitikimas Varšuvoje

Birželio 16 dieną Lietuvos Respublikos ambasadoje Varšuvoje įvyko lietuvos kapitalo įmonių, veikiančių Lenkijoje, vadovų susitikimas.

-

18

Birželis - Ketvirtadienis

Varšuvoje apie verslo galimybes Lietuvoje

Praėjusį pirmadienį (birželio 15 d.) Ūkio ministerijoje Varšuvoje įvyko konferencija skirta lenkiško kapitalo įmonėms, kurios yra suinteresuotos...

-

16

Birželis - Antradienis

Lenkijoje veikiančių Lietuvos įmonių patirtis

Antradienį, 2015 m. birželio 16 d, Lietuvos ambasadoje Varšuvoje vyks susitikimas, kuriuo metu bus aptarta Lenkijos rinkoje veikiančių Lietuvos...

-

15

Birželis - Pirmadienis

Prekybos ir investijų galimybės Lietuvoje

Pirmadienį, 2015 m. birželio 15 d., Varšuvoje, vyks seminaras, kurį organizuoja Lenkijos ir Lietuvos prekybos rūmai bei Lenkijos ambasados Vilniuje...

- 02 Birželis - Antradienis Lenkijos ir Lietuvos prekybos rūmų I-asis Business Mixer Pirmadienį (birželio 1 d.) viešbutyje Kempinski Vilniuje įvyko Lenkijos ir Lietuvos prekybos rūmų I-asis Business Mixer.

-

29

Gegužė - Penktadienis

Energy Dialogue in Seimas

Jau šį penktadienį, gegužės 29 d., Lietuvos Respublikos Seimo rūmuose vyks eilinė diskusija iš ciklo „Energy Dialogue in Seimas”. Diskusija bus...

- 13 Gegužė - Trečiadienis Lenkijos ir Lietuvos prekybos rūmai energetikos forume Rūmai buvo Vilniuje organizuoto energetikos forumo partneriu. Forumas įvyko 2015 m. gegužės 13 d. viešbutyje „Kempinski”, Vilniuje. Vieną...

-

12

Gegužė - Antradienis

Iškilminga vakarienė su Lenkijos ir Lietuvos prekybos rūmų nariais

Antradienį, gegužės 12 d., Lenkijos ir Lietuvos prekybos rūmų nariai susitiko per iškilmingą vakarienę. Vienas pagrindinių Rūmų tikslų - jų narių...

-

28

Balandis - Antradienis

Lenkijos ir Lietuvos prekybos rūmų atstovų vizitas į Kauną

Praėjusį antradienį Lenkijos ir Lietuvos prekybos rūmų atstovai kartu su Estijos bei Latvijos prekybos rūmų atstovais aplankė Kauno Laisvąją...

- 24 Balandis - Penktadienis Susitikimas su Lenkijos Respublikos ambasadoriumi Lietuvoje Š. m. balandžio 24 d. Lenkijos Respublikos ambasadoje Vilniuje įvyko Lenkijos ir Lietuvos prekybos rūmų narių susitikimas su Lenkijos Respublikos...

-

24

Balandis - Penktadienis

Susitikimas su ambasadoriumi

Balandžio 24 d. vyks narių susitikimas su Lenkijos ambasadoriumi.

-

19

Kovas - Ketvirtadienis

Konferencija “Energy security and economic effects of nuclear energy...

Kovo 19 dieną Vilniuje įvyko konferencija, kurios metu buvo aptarti energetinio saugumo ir atominės energetikos plėtros naudos ekonomikai...

-

13

Kovas - Penktadienis

Lenkijos ir Lietuvos prekybos rūmai yra vieni Energy Dialogue Seime...

Lietuvos Respublikos Seime šiandien įvyko konferencija Energy Dialogue in Seimas, seminaras, kurio metu buvo aptartos bendros Europos energetikos...

-

12

Kovas - Ketvirtadienis

Įsteigti Lenkijos ir Lietuvos prekybos rūmai

Kovo 12 dieną buvo įregistruota asociacija “Lenkijos ir Lietuvos prekybos rūmai”. Rūmų valdybos pirmininku buvo paskirtas Jaroslav Neverovič, buvęs...

naujienos / 2019 12 18 ESTABLISHMENT OF A CLOSED JOINT STOCK COMPANY IN LITHUANIA

Doing business in Lithuania is possible having the appropriate legal form. A foreign investor is entitled to conduct business activity in Lithuania through an established legal person, branch, representative office or permanent establishment (registration at the tax office).

This article presents the requirements and conditions for the foreign investor to establish one of the most popular legal entity’s form in Lithuania - a closed joint-stock company (in Lithuanian language “uždaroji akcinė bendrovė" or “UAB”).

A company with a legal form is an independent Lithuanian legal entity. A foreign investor is entitled to start a business in the Republic of Lithuania under the same conditions and to the same extent as Lithuanian entities.

However, before starting a business, a closed joint-stock company should be registered in the Register of Legal Entities first. In the Register of Legal Entities, all legal persons should provide required statutory data about themselves and their activities. The organization administrating state registers in Lithuania is the state-owned enterprise Centre of Registers (in Lithuanian language VĮ "Registrų centras", www.registrucentras.lt).

Before the submission of an application for registration of a closed joint-stock company in the Register of Legal Entities, the notary public should confirm the compliance of the information contained in the documents, compliance of the statute with legal requirements and the fact that registration of the company is possible.

In order to establish a closed joint-stock company by a foreign legal entity, the following legal documents are required by the notary:

- Statute (in Lithuanian language “įstatai”). The company's statute is a document, which the company uses in its activities. The statute must indicate the name of the company, legal form, share capital, number of shares, objectives, description of the company's operations, company bodies, their competences and other information that is necessary in accordance with the Law on Companies of the Republic of Lithuania. It should be noted that in Lithuania there is a mandatory one-person corporate body - the manager (director) of the company. When establishing a company, a shareholder may optionally appoint a supervisory board or a management board. However, these management bodies are not mandatory. If a supervisory board is elected, then before registering the company, it should elect the management board or the manager of the company if the management board is not appointed. If only the management board of the company is appointed, the chosen board should choose the head of the company. In the event that neither the management board nor the supervisory board are appointed, the manager of the company is elected by the shareholder (s). It should be noted that in practice it is most common to meet only one corporate body - the company's manager (director). The management board and the supervisory board are usually appointed in very large companies (usually state-owned), where in such a way the risk of improper management and responsibility is divided.

- Incorporation agreement (in Lithuanian language “steigimo sutartis”) or the incorporation act (in Lithuanian language “steigimo aktas”). Incorporation agreement, minutes of the constituent meeting and the list of shareholders of a closed joint-stock company is necessary when the company is established by more than one person. If a company is established by one person only, it is enough to sign the incorporation act.

- Written confirmation from the bank on the paid-up share capital. The signed incorporation agreement or the incorporation act gives the right to open a cumulative bank account of the company. When the cumulative bank account is opened, the shareholder shall deposit the capital, which shall be equal to acquired shares. The minimum share capital of a closed joint-stock company is 2,500 euros. It should be noted that after the company is established, the company is entitled to use the share capital in its daily operations. When the share capital is paid into the opened cumulative bank account, it is necessary to get a written confirmation from the bank that the share capital is fully paid.

- Extract from the register in which the foreign legal entity (shareholder) is registered. The extract must be confirmed by an apostille and translated into Lithuanian language. If, in accordance with the law of a foreign state, an extract is not issued, another document confirming the fact of registering a legal person is required.

- Written permission to register the company's registered office address. It should be noted that in the incorporation agreement or in the incorporation act it is necessary to indicate the registration address of the company being established. The company's registration office address is one of the essential conditions for the establishment of a company. Permission to register the company's registered address must be issued by the owner of the property. When a company is registered in a real estate, which is owned by natural persons, a notarial form of a permission is required. If the property is owned by several owners, the approval on the company‘s registration must be signed by all owners. When a company is registered in a real estate, which is owned by a legal person, a written permission, signed by the representative (head) of the legal person is required. It shall be noted that such permission does not have to be certified by a notary. If the premises are pledged to the bank, the bank's written consent to register the company’s registered office address is required as well.

- A copy of the ID card or passport of the members of the management board (if appointed), the supervisory board (if appointed) and the manager of the established company, if the appointed persons are non-residents of the Republic of Lithuania.

With the registration of a new company in the Register of Legal Entities, it is possible to register a new company as a VAT payer (in Lithuanian language “PVM mokėtojas”) as well. The tax inspectorate will automatically receive information about the registration of a new company, and the decision will be forwarded within three business days via the electronic system of tax inspectorate.

If, during the registration, a closed joint-stock company does not intend to register as a VAT payer, such right can be used in the future. It should be noted, however, that each closed joint-stock company that within 12 months imported goods worth 14,000 euros from European Union countries or has achieved revenues of 45,000 euros, should register as a VAT payer.

A fee of 57.34 euro is charged for the registration of a closed joint-stock company in the Register of Legal Entities. Fee in the notary’s office is around 180 euros.

Although it is possible to establish a company also electronically in Lithuania, however, the possibility of establishing such a company is only available to persons with an electronic signature (for residents of the Republic of Lithuania), therefore this option was not analyzed in this article.